Money Management Tips Intraday Trading

Avoid Losses Intraday or Swing Trading

Traders Lose or Gain depending upon their money management system. If the trader is good at maintaining proper money management then success shall follow. Losing is a part of trading but losing less and winning more will lead them to succeed.

List of Simple Money Management Tips to Avoid Losses in Intraday Trading Strategy.

- Limit your losses by keeping track of your winning and losing trades money saved is money gained.

- Learn to reduce your losing trades and increase your winning trades

- Losses cannot be reduced just by decreasing the number of trades but by minimizing the loss in a losing trade.

- The percentage of winning trades versus losing trades must be more.

- Maintain a risk-reward ratio.

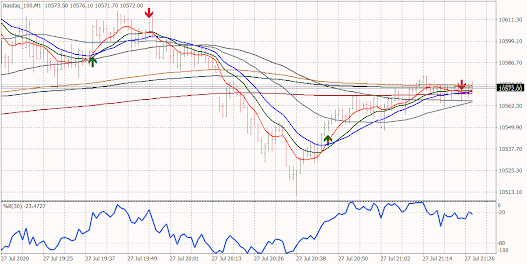

- Use trailing-stop loss to maximize the profit in a winning trade and stop loss to minimize the loss in a losing trade.

- Successful traders minimize losses, reduce losing trades, and maximize profits by increasing winning trades.

- No trader becomes successful overnight it takes time, experience, commitment, discipline, and money management skills.

- In the initial stages do not invest huge amounts in order to gain huge amounts it is not possible to gain that way. Invest a small amount and make small gains initially and consistently the profits itself accumulate.

- The first step to success is limiting the losses.

- Success in trading comes by limiting the losses and gaining.

- To be successful you either increase the number of winning trades or increase the profit amount and limiting your losses.

- Once the loss is heavy the capital gets eroded and the profit earning capacity of the capital is also reduced.

- A seasoned trader can make profits in all types of markets whether bullish, bearish, or volatile market conditions by knowing how and where to cut losses.

- All losses are small at the beginning and keep growing to become huge.

- Cut losses at the beginning.

- A common mistake is letting the losses grow hoping that it reduces without making any effort of reducing it.

- But the market has other plans it keeps increasing the losses which go to a proportion that when you want to cover it you have to take huge losses, which ultimately blocks your mind to take decisive action, later.

- It is always important to cover the losses when the loss is bearable and not leave until it becomes unbearable.

- Exit if you feel the trade is not moving in your direction, put a stop no matter how confident you feel. Do not wait for the losses to come down, it may not so Quit the trade immediately to cut your losses. Take a different trade or quit for the day.