LAST HOUR INTRADAY STRATEGY

The advantage of Last Hour Intraday Trading Strategy:

- In this trade is there is no chance of over trading or averaging because of the paucity of time and there is only one entry, in the direction of the trend of the stock. Either you gain or lose with the last hour and there is less pressure or stress on the traders and the judgement making is very clear.

- Since you are trading in the last hour, before entering the trade, you have a chance of analyzing the chart for the entire day and draw your conclusion of the trend and further movement of the price of the stock and make an entry.

- In this Last Hour Intraday Trading Strategy, you will have a good target and a low-risk stop loss because you can identify and know all the supports and resistances of the day, lows, highs, and the averages that are already made for the day.

- If the stock is strong throughout the day there is every possibility of the price continuation in this Last Hour Intraday Trading Strategy and fewer chances of it reversing in the Last Hour thus reducing the risk.

- This low-risk Last Hour Intraday Trading strategy requires you to select a stock that has withstood all the ups and downs of the market and is very strong throughout the day.

- The chances of failure are less in Last Hour Intraday Trading strategy because the particular stock is strong throughout the day, there is every possibility of the stock to become even stronger at the end of the trading day or in the closing hour.

- Last Hour Intraday Trading strategy or closing hour trading can give you good returns or gains. The strategy is to select a stock that has withstood all the day's market volatility, trading above or below the average depending upon the trend bullish or bearish. See that the stock is trading with good volumes and is trending in only one direction throughout the day.

Selecting the Last Hour Trade.

- A good stock for long trade is the stock that is trading above the average for the entire day. Make an entry in the dip, place stop-loss at the support or below the average.

- A good stock for short trade is the stock that is trading below the average for the entire day. Make an entry, place stop-loss order at the resistance or above the average.

- Follow all the trading rules.

trader-qualities

first-15-minutes

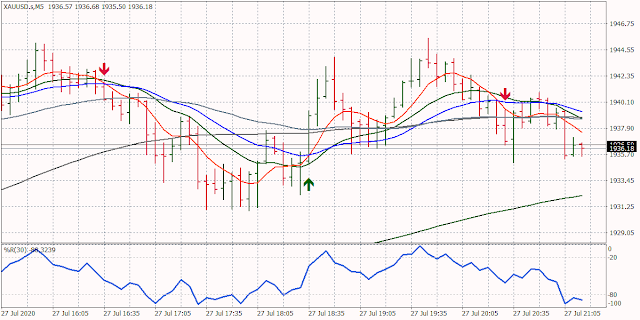

gold-trading-strategy

drawdown-and-leverages

opening-hour-behavior

advice-from-successful-traders

know-your-trading

consistent-intraday-trading-strategy

last-hour-strategy

money-management-tips

entry-exit-time

common-repetitive-mistakes

pick-right-stocks

stop-loss-placing

50-trading-rules-2021

wma-chart-setup

strong-mind-control

suggestions-for-new-traders

intraday-trades